China’s situation on the world stage is changing quickly as it moves to turn into an essential contender to occupant monetary forces to be reckoned with. Not least due to the new exchange struggle between the US and China and its drawn-out aftermath just as the COVID-19 flare-up, companies really should recalibrate their assembling associations with the Chinese market.

While numerous producers began to send a China +1 strategy previously, I accept a methodology including further broadening (China +x) yields various freedoms and benefits. I will examine different nations and locales all over the planet as far as appropriateness to supplant producing abilities presently kept up within China.

For every elective area, I will examine a) upsides and downsides, b) present status, and c) viewpoint for each significant market. I will zero in on the accompanying boundaries: labor force, efficiency, framework, utilities, tax collection, international alliances (FTAs), political soundness, law, and order, and saw debasement.

Meaning of the Chinese Manufacturing Industry for Global Markets

China’s product-situated assembling businesses are essentially amassed in labor-concentrated and innovation-driven enterprises, as indicated by the McKinsey Global Institute. Appropriately, materials/attire (40% of worldwide products), just as PCs/hardware (28%) and electrical gear (27%), are standing out as far as the market significance of China-based makers.

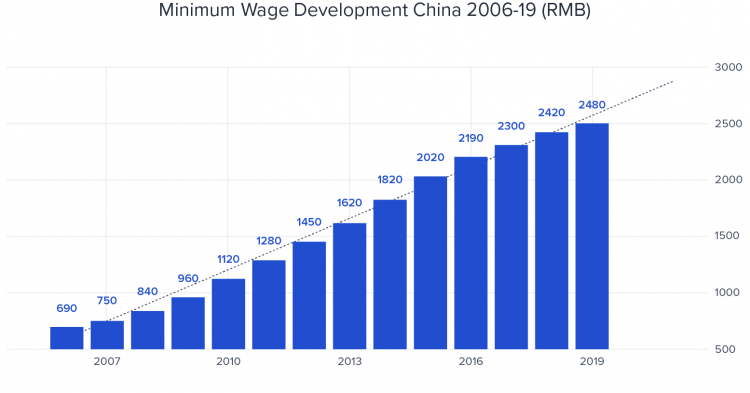

Work costs in China’s assembling area have seen a consistent ascent in the course of the most recent twenty years, which is driven by various elements:

Segment impacts (e.g., one-youngster strategy)

Restricted movement opportunity from rustic regions to urban areas

Administrative effects bringing about consistent ascents of least wages

While the work cost effect of the initial two drivers is fairly hard to measure, the ascent in the least wages is very much archived. While still at an unobtrusive level, starting around 2006, least wages in China almost quadrupled while they remained practically level in most OECD nations.

While various assembling areas in China have adjusted via mechanizing creation and moving the concentration to homegrown purchaser advertises, the effect on the seriousness of China’s assembling area is as of now not immaterial. More huge, in any case, is the generally apparent effect of China’s exchange and non-exchange relationship with its significant exchange accomplices. Furthermore, the new COVID-19 episode and its problematic effect on the stockpile chains of organizations with creation offices in China has prompted impressive soul-looking in various meeting rooms to recalibrate worldwide obtaining and production network systems.

In that capacity, producing outside China areas should be assessed to diminish the reliance on China-based re-appropriated fabricating and additionally China-based plants to supply worldwide business sectors.

Since the accessibility of a certified and minimal expense worldwide labor force ended up being a significant draw for China’s ascent, elective areas should be assessed on that specific rule. Nonetheless, different boundaries are of comparable significance. Consequently, the conversation of migration openings will likewise zero in on political steadiness, accessibility of utilities and transport foundation, accessibility of financing, tax collection, and the administrative system (simplicity of carrying on with work) just as the opportunity of capital streams.

Fabricating Outside China—Where Next?

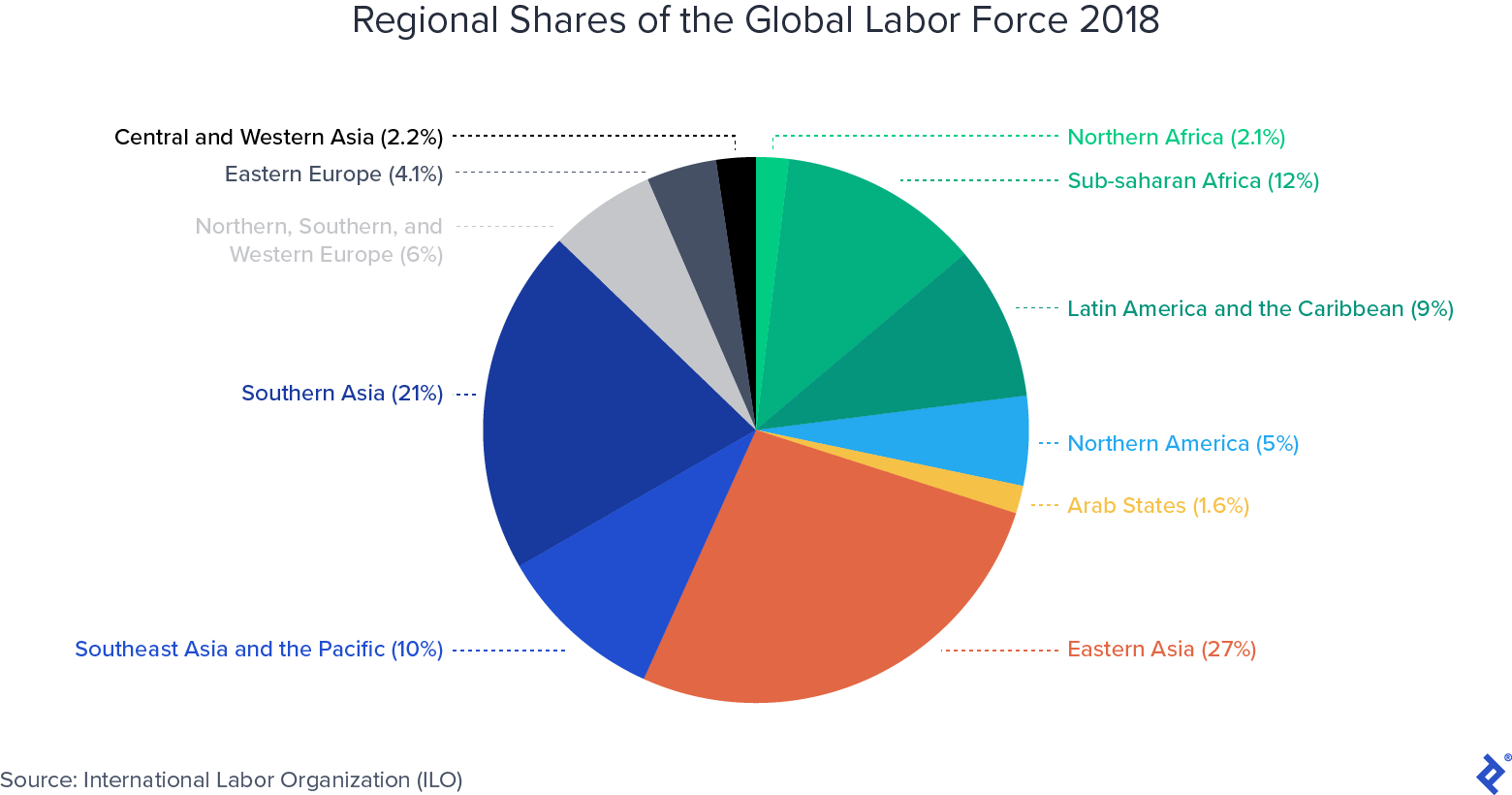

The greater part of the world’s labor force is situated in Asia and the Pacific, as per the International Labor Organization (ILO), a UN office. One more 14% are situated in African nations, specifically Sub-Saharan Africa.

While there is positively potential to carry back assembling abilities to western economies in Europe and North America involving computerization just as cost benefits because of exchange passageways and lower transport costs, the focal point of this investigation will be on work replacement.

Producing Relocation Opportunities

Eastern Asia – Major Players, Opportunities

The Eastern Asia locale makes up 27% of the worldwide workforce, comprising of China, Hong Kong, North Korea, the Republic of (South) Korea, Macau, Mongolia, and Taiwan. With moderately little and additionally rather costly labor forces, Hong Kong, Macau, Mongolia, and Taiwan don’t actually have the potential for assembling shifts from China.

North Korea, with a labor force of 14 million individuals, would have the potential for a fractional assembling movement. Nonetheless, aside from roughly 100,000 North Koreans working pretty much straightforwardly in different worldwide business sectors as a component of government-supported work-trade programs, the nation is to a great extent shut out from global assembling because of the UN and different assents forced.

South Korea, then again, with its 28 million-in-number labor force, is very much positioned to catch a piece of the approaching China substitution fabricating limit.

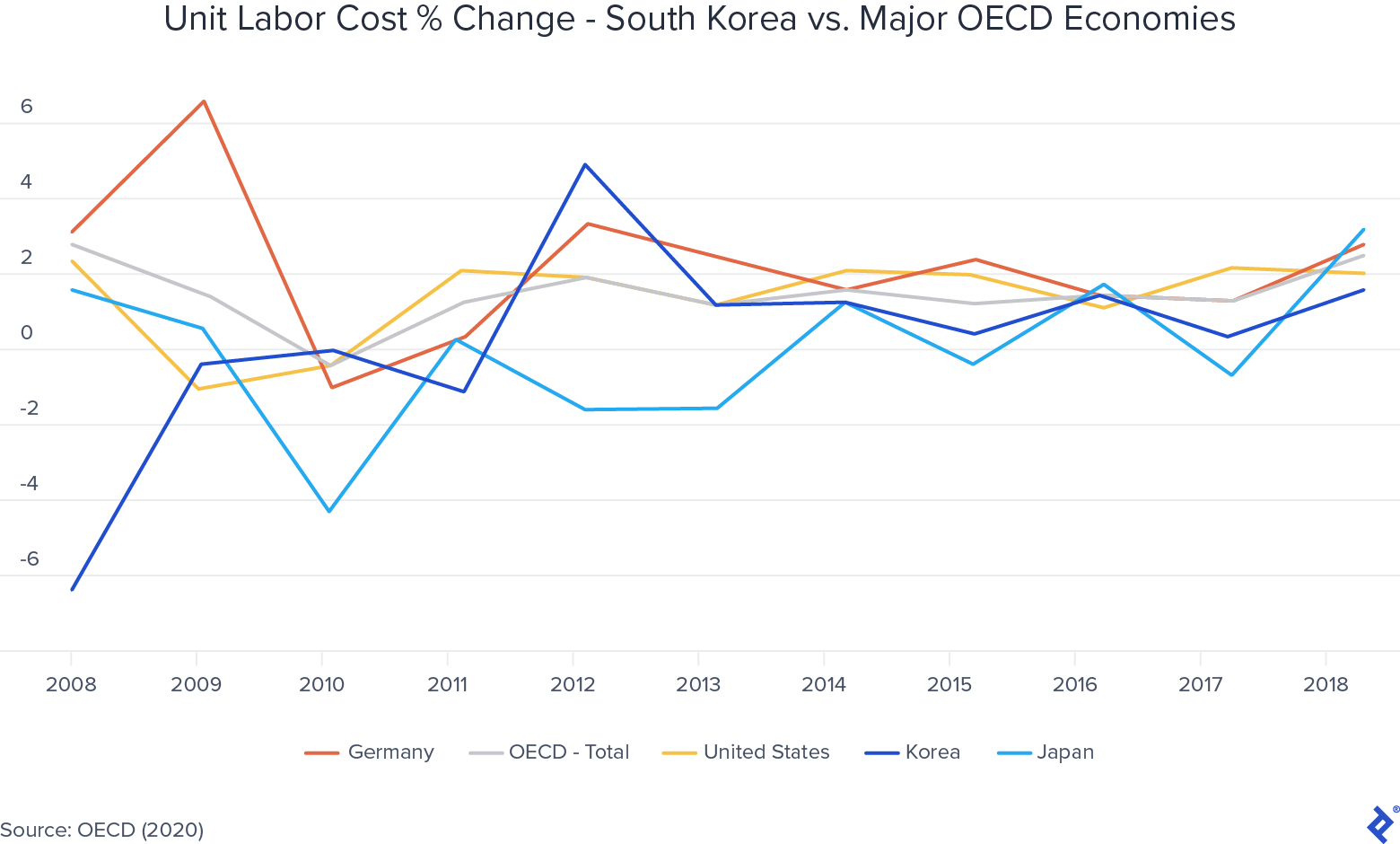

| Workforce | 28-million-strong labor force with high productivity (graph below), converging unit labor costs; >90% tertiary educational enrollment; flexible labor laws |

| Productivity | Approximately 10% higher than major OECD economies (see graph below) but similar unit labor cost (see 2nd graph below) |

| Infrastructure | Well-developed road, airport, and rail network; strong port/container port infrastructure (Busan in the southeast and Incheon in the west) with easy access to China and Japan |

| Utilities | Electricity – self-sufficient but high fossil fuel dependency (70%) Crude Oil – 100% import-dependent (fifth largest importer globally) Natural gas/LNG – almost 100% import-dependent (ninth largest importer) |

| Competitiveness (a) | 79.6 (max 100) |

| FDI confidence (b) | 1.54 (max 3) |

(a) WEF rating involves 12 mainstays of seriousness: Institutions, Infrastructure, ICT reception, Macroeconomic strength, Health, Skills, Product market, Labor market, Financial framework, Market size, Business dynamism, and Innovation ability.

(b) AT Kearney rating; overview based, high/medium/low appraising the 3-year forward-looking FDI likeliness in the specific market

The main concern (Eastern Asia)

With its profoundly qualified and proficient workforce, usefulness, and foundation, South Korea gives substitution freedoms to differentiate a portion of the great intricacy producing as of now taken care of out of China. Given its generally solid exchange associations with the Chinese economy just as geographic vicinity, producing movements, and store network, rerouting ought to be thought of.

Southern Asia – Major Players, Opportunities

The southern Asia locale is characterized as a space comprising of Afghanistan, Bangladesh, Bhutan, India, the Maldives, Nepal, Pakistan, and Sri Lanka.

Both Bhutan and the Maldives have a workforce of under 1 million and will subsequently be dismissed. Notwithstanding a workforce of in excess of 14 million, Afghanistan has likewise been ignored because of its unpredictable security circumstance.

Aside from India, which is a significant potential work market, this part will likewise talk about Bangladesh, Nepal, Pakistan, and Sri Lanka as far as their assembling movement potential.

So how about we start by investigating India, one of the more clear decisions to broaden fabricating limit away from China.

| Workforce | 520-million-strong workforce with a 75% literacy rate, 75% secondary school enrollment, and 28% tertiary education (university & similar) enrollment |

| Productivity | $9 USD GDP/hour worked (i.e., less than 10% of the OECD average) |

| Infrastructure | Rail network and container port infrastructure on par with China in terms of quality, but only 7% of China’s overall container terminal capacity; medium-quality air and road transport infrastructure (on par with China) |

| Energy | Electricity: 100% self-sufficient, >70% fossil dependency Crude oil: top five global crude importer Natural gas/ LNG: top 20 global gas importer |

| Competitiveness (a) | 61.4 (max 100) |

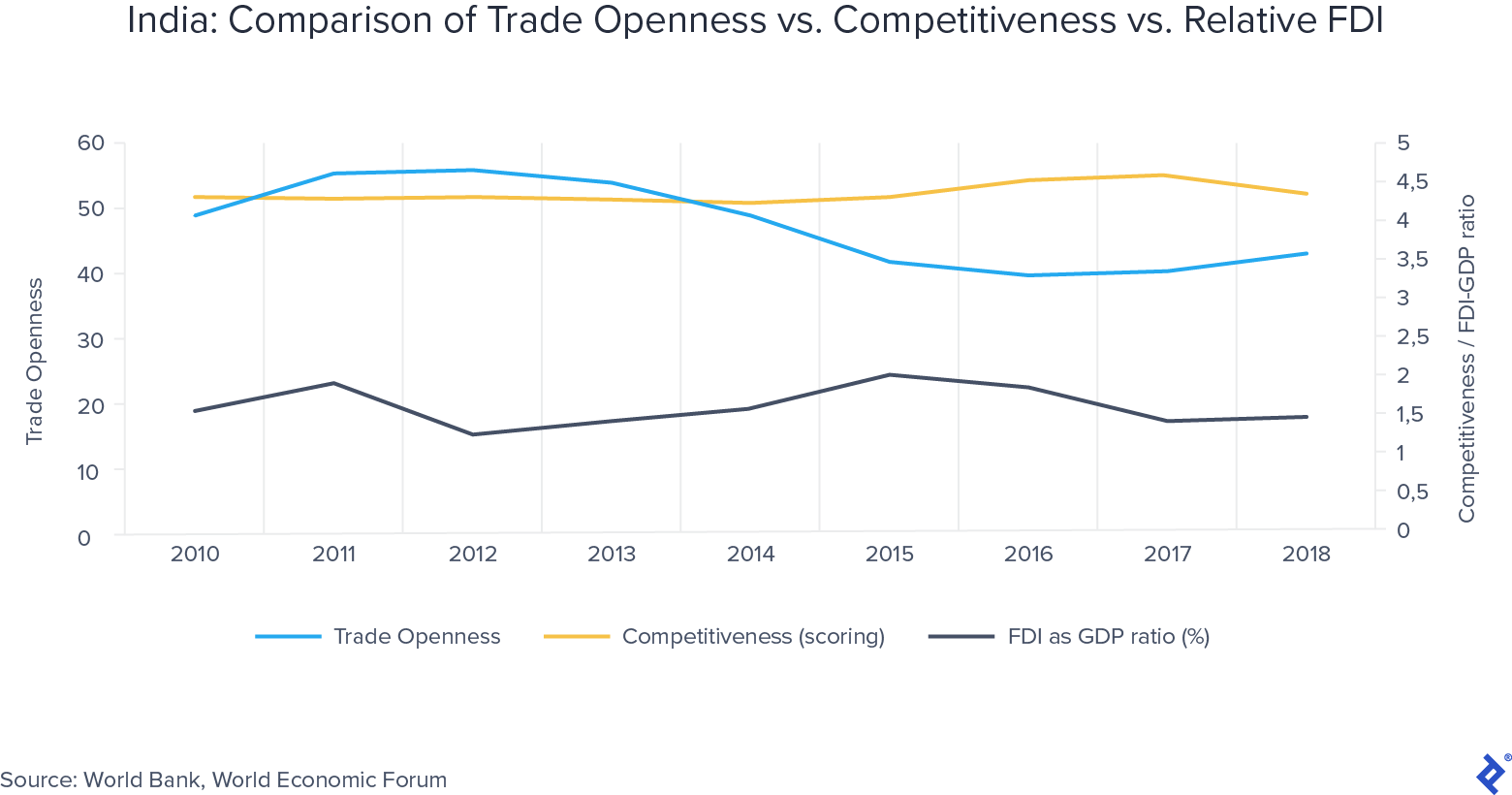

| FDI confidence (b) | 1.54 (max 3), down from a 1,85 rating in 2012 |

(a) WEF rating involves 12 mainstays of intensity: Institutions, Infrastructure, ICT reception, Macroeconomic steadiness, Health, Skills, Product market, Labor market, Financial framework, Market size, Business dynamism, and Innovation ability.

(b) AT Kearney rating; review based, high/medium/low evaluating the 3-year forward-looking FDI likeliness in the specific market

Things being what they are, India has a huge, knowledgeable labor force and is ready to take over from China to turn into the world’s next workbench, correct? All things considered, prior to making a determination on India’s reasonableness and availability to assume control over, it is beneficial to check out a couple of more financial and monetary boundaries, beginning with FX rates and expansion.

Driven by vulnerability encompassing the absence of market changes just as political danger, loan fees consistently rose before 2014. Notwithstanding, this insight changed with the Modi Government executing further market changes alongside financial discipline following its 2014 political decision.

Be that as it may, this force stopped later in 2016, when government strategies like “demonetization” (dropping of enormous banknote sections) and the presentation of the Goods and Services Tax smothered homegrown utilization. With the proceeded with heavenly recuperation direction of western business sectors, FDI financial backers chose to leave or pass on interests in India.

Primary concern (India)

India gives critical substitution freedoms to assembling capacities and to rehash the achievement showed by its rethinking and IT area in the course of recent many years. Be that as it may, huge issues remain—prominently, improvements and privatization of the swelled government area, sex issues, absence of reasonable framework, and administrative obstacles.

Regardless of every one of these, I trust that, rather than China, the equivalently lesser frictional potential among India and the western world will pull together the West’s consideration toward the Indian eco