How to Calculate Brand Value?

Accordingly, we should utilize an extremely shortsighted definition: Brand esteem is the worth by which a thing can be sold over the value that the stockpile/request bend directs.

As far as estimating brand esteem, one way is to recognize the edges of individual items and look at them across different brands. Assuming one organization can separate additional benefits from precisely the same item, we could propose that the brand is more grounded. Notwithstanding, there are numerous factors that might slant this investigation – and the stockpile/request bends may not be actually something similar.

Another way is to view organizations overall. Assuming financial backers will pay more for a dollar of profit of Company A than Company B – all else being equivalent – we could contend that the brand of Company An is more grounded than that of Company B.

The Importance of the PEG Ratio

For the most part, the proportion of how much a financial backer will pay for a dollar of profit is the Price/Earnings proportion. In any case, this proportion likewise consolidates development assumptions regarding the singular organization. In that capacity, we can utilize the PEG (“Price/Earnings partitioned by Growth”), which normalizes the normal development. Assuming that the organizations are really offering similar items, we would anticipate that the PEG ratios should be generally something very similar (other peculiar elements might affect a stock’s value, which would eventually affect the PEG, however, we would anticipate that they should be generally something very similar).

Evaluating Brand Valuation in Athletic Apparel and Luxury Goods

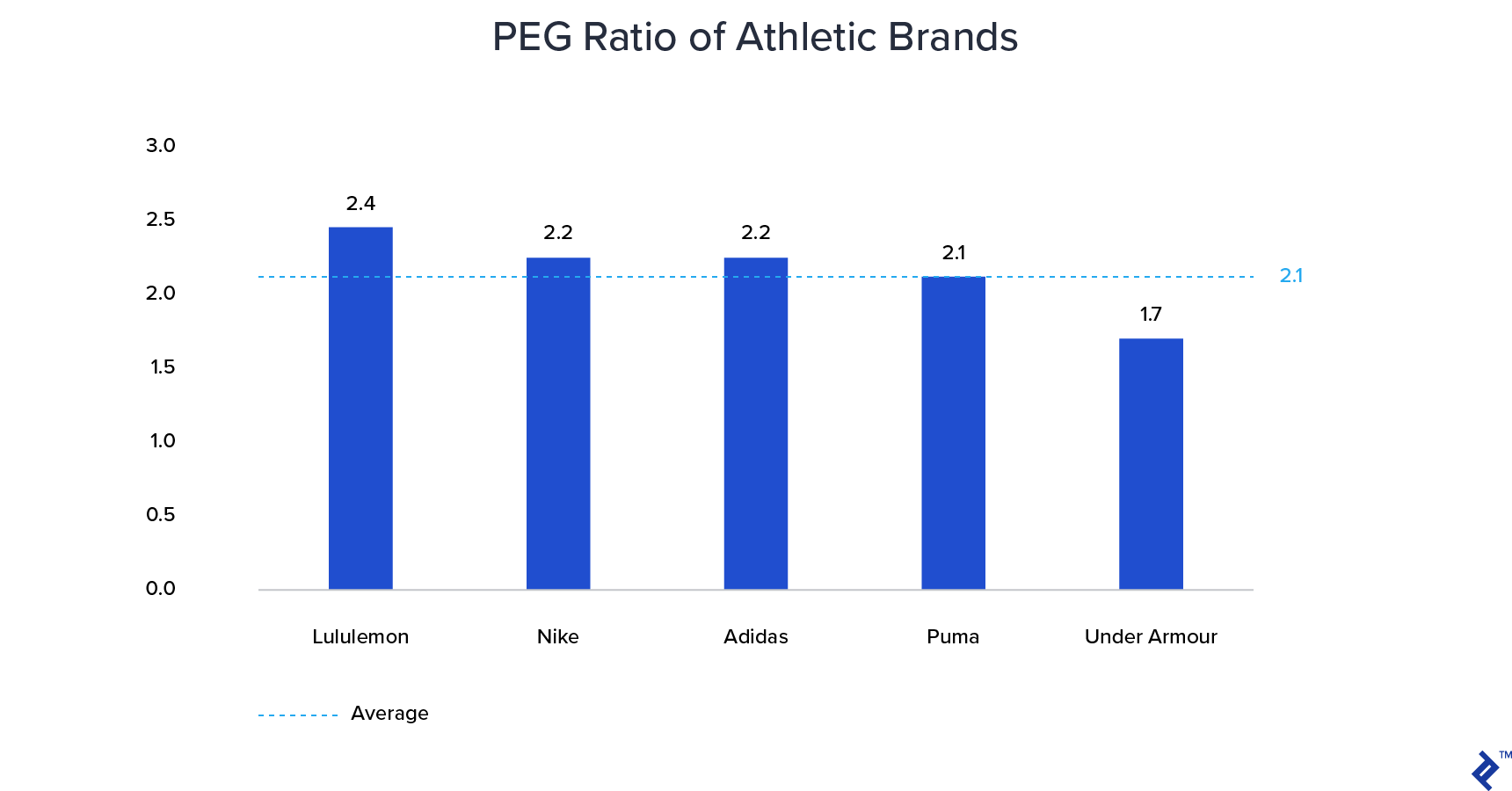

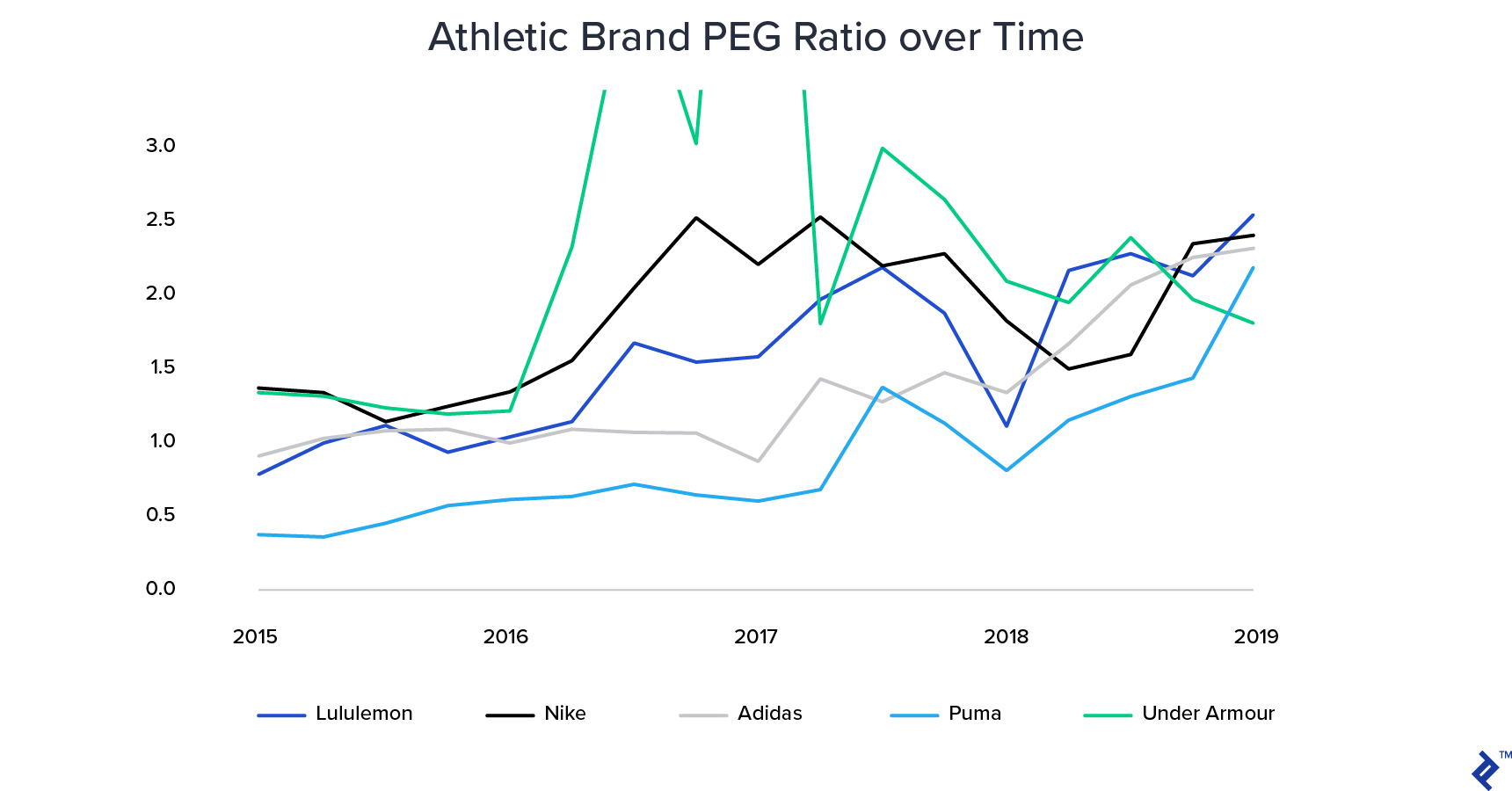

To more readily delineate this point, we should check out a variety of public athletic brands: Lululemon, Nike, Adidas, Puma, and Under Armor. Given the wide similitudes and fungibility of item contributions, we wouldn’t expect critical brand esteem from any of these organizations. Somebody might settle up for Nike versus Jaguar, however at one point, running shoes are running shoes, and the brand can indeed represent a limited amount a lot of significant worth. Besides, athletic brands make down-to-earth items, so individuals are getting them for work as much as – if not more than – structure.

As may be obvious, our hypothesis was comprehensively right. There is little variation between the PEG proportions of the five organizations, with the exceptions (Lululemon and Under Armor) both inside 0.4 PEG units of the normal.

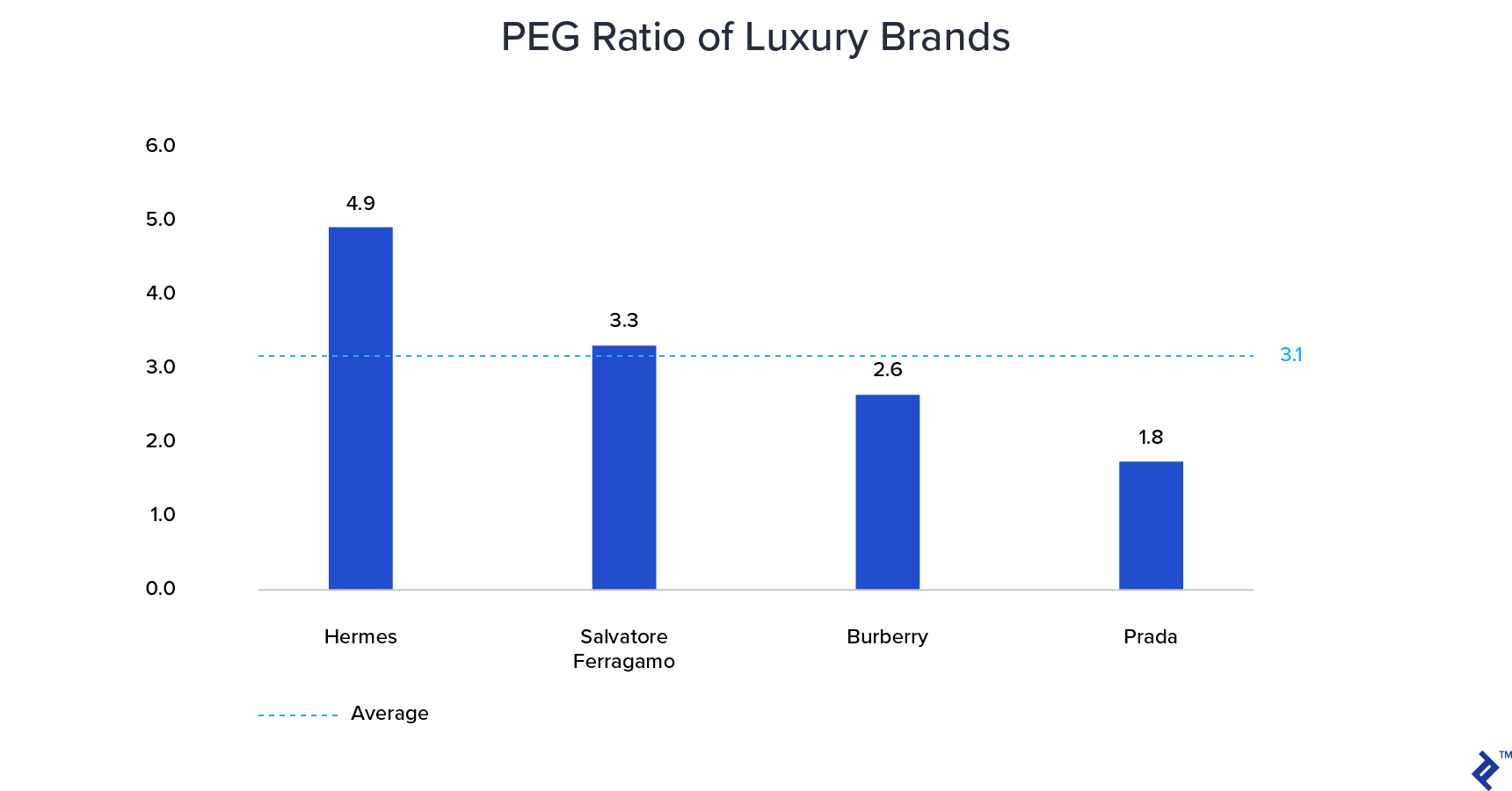

Then again, there are organizations that are exclusively selling a brand. Individuals for the most part comprehend that there is a huge markup for their items however will pay given the more extensive ramifications (societal position, “reliability,” and so forth) related to the brand. These organizations are by and large alluded to as “extravagance brands.” To check out these organizations, we should utilize Hermes, Salvatore Ferragamo, Burberry, and Prada.

Here, we can see there is a lot more prominent variety. Indeed, the PEG proportion of Hermes is practically 3x of Prada! While the athletic brands were all inside a band of +/ – 0.4 PEG units from the normal, the extravagance brands extend to +/ – 1.8 PEG units.

Up until this point, we have utilized the term PEG units without really getting what it implies on a hidden premise. Considering that the PEG proportion is how much cash is paid for a dollar of income – accepting equivalent development among the member set, we can decide the effect of an organization’s image esteem on its general worth.

In doing as such, how about we initially appoint each organization the normal PEG proportion for the friend set – for this situation, 3.1 (doled out as letter “A”) – and duplicate it by the organization’s assessed development (“B”). Doing as such will get us a “Normalized P/E” (“C”).

| A | x B | = C | |

| Peer Set PEG | Estimated Growth (%) | Standardized P/E | |

| Hermes | 3.1 | 9.1 | 28.7 |

| Salvatore Ferragamo | 3.1 | 10.2 | 32.0 |

| Burberry | 3.1 | 8.5 | 26.6 |

| Prada | 3.1 | 19.9 | 62.4 |

Utilizing this Standardized P/E (“C”) and duplicating it by each organization’s assessed profit (“D”) will give us an “Inferred Share Price” (“E”). Keep in mind, this “Suggested Share Price” is determined as though every one of these organizations has the very same “brand esteem” – all in all, it is “brand esteem unbiased.”

Since we have some feeling of the “brand-impartial worth” share value, we can contrast this worth and the real provided cost estimate in the market by taking away our suggested share value (“E”) from the current piece of the pie value (“F”). Doing as such gives us the money worth of the premium or markdown by which the public offer varies from the “brand-unbiased worth” (“G”).

| C | x D | = E | |

| Standardized P/E | Estimated Earnings | Implied Share Price | |

| Hermes | 28.7 | €14.54 | €416.76 |

| Salvatore Ferragamo | 32.0 | €0.53 | €16.98 |

| Burberry | 26.6 | £0.89 | £23.70 |

| Prada | 62.4 | HKD 0.82 | HKD 50.89 |

At long last, by taking this money premium or markdown (“G”) and duplicating it by the absolute number of offers remarkable (“H”), we can gauge the hypothetical contrast of the organization’s genuine image when contrasted with its image nonpartisan valuation (“I” – introduced in both nearby cash and US dollars).

| F | – E | = G | |

| Current Market Share Price | Implied Share Price | Premium/Discount per Share | |

| Hermes | €652.00 | €416.76 | €235.24 |

| Salvatore Ferragamo | €17.62 | €16.98 | €0.64 |

| Burberry | £19.88 | £23.70 | (£3.82) |

| Prada | HKD 28.45 | HKD 50.89 | (HKD 22.44) |

Presently, it is not necessarily the case that Prada has a brand valuation of negative $7.3 billion. Be that as it may, given the distinction in brand esteems versus the brand-unbiased worth can construe that were Prada viewed as a “normal brand” when contrasted with this friend set, the organization would encounter an increment in market capitalization of $7.3 billion – as we are adapting to outright marketing projections and assessed development. Also, we can say that Hermes might have an extra $27.5 billion of significant worth exclusively because of its image.

| G | x H | = I | ||

| Premium/Discount per Share | Shares Outstanding (millions) | Theoretical Brand Value (millions) | ||

| Local Currency | USD | |||

| Hermes | €235.24 | 105.6 | €24,834 | $27,510 |

| Salvatore Ferragamo | €0.64 | 168.8 | €108 | $120 |

| Burberry | (£3.82) | 408.4 | (£1,560) | ($2,045) |

| Prada | (HKD 22.44) | 2,558.8 | (HKD 57,427) | ($7,335) |

Similarly, as we had the option to finish this investigation for our extravagance image peer set, we can likewise take a gander at the athletic brands. Rather than copying the full technique, if it’s not too much trouble, see the outcomes underneath:

As talked about above, we would anticipate that these numbers should be more modest than those of the extravagance brands, given the fungibility of athletic items and the more prominent flexibility of interest for athletic items, compared with extravagance items. Indeed, even Nike, which notionally has extremely high brand esteem, is fairly deceptive given its monstrous size (Nike has an endeavor worth $154.3 billion). According to its endeavor esteem, the brand just addresses ~5.0%.

| Theoretical Brand Value (millions) | ||

| Local Currency | USD | |

| Lululemon | $3,439 | $3,439 |

| Nike | $7,743 | $7,743 |

| Adidas | €1,580 | $1,745 |

| Puma | (€362) | ($400) |

| Under Armour | ($903) | ($903) |

Refining the Analysis

Clearly, there are critical issues with this examination, and we are disregarding various issues that would affect the worth of an organization: fundamental and particular variables in the functional and additionally monetary components. For instance, a specific stock cost could be affected by specialized factors, for example, a Relative Strength Index, which could recognize shares as either overbought or oversold. In like manner, an organization might experience an inventory network disturbance, land a major agreement, or have some other functional advancement that impacts its portion cost. While these events should move through to the assessed development and value/profit proportion of an organization, the market may not be completely educationally proficient. While it requires some investment for data to spread and be deciphered by the market, certain PEG proportion patterns might be exacerbated.

That being said, regardless of whether we can not actually measure the dollar worth of a brand, we could utilize relative PEG proportions over the long haul to investigate the overall strength of brands over the long run.

While doing this examination for the recently talked about athletic brands, we can see that Puma has forever been at the lower part of the pack, while Lululemon and Nike have kept up with generally solid positions. Under Armor has encountered critical unpredictability in its PEG proportion (up to 7.8x), with the end goal that it surpassed the limits of the outline on occasion. At last, Adidas has consistently further developed its insight (in light of its overall situation to Nike, rather than the overall vertical pattern, which is in all probability intelligent of rising P/E proportions in the business in general) and is presently thought to be comparable to Lululemon and Nike.

This examination was a convoluted method for approximating a worth that shows itself in a wide range of ways. We haven’t talked about the roundabout idea of the speculation – assuming that a brand is more grounded, it ought to be reflected in a higher development rate which would bring down its PEG proportion.

That being said, rather than being a conclusive response, ideally, it will spike further musings about the worth of an organization’s image.

As some reality “setting” to the athletic brand investigation, in the fall of 2019, a profoundly exposed claim including New Balance, Nike, and Liverpool Football Club was closed. The case shed light on the subtleties of how brand valuation is seen through the crude business terms (for this situation, retail reach, and clout) that aren’t promptly clear when scrutinizing the monetary proportions of an organization.

How Does Technology Build Brand Valuation?

As an ever-increasing number of items are being sold direct to shoppers, and innovation gives firms more prominent control of their marking, the capacity to produce positive brand esteem is fundamental for firms of any size.

In a future post, I will examine ways and contemplations that new companies and beginning phase organizations can move toward building brands, and utilizing that worth to raise capital.