The pandemic waves attacked the economy and individuals’ possibilities, however, the people who have been reserving cash under their beddings are moderately secure. Nonetheless, many individuals weren’t that far-located and wound up connecting with banks for credits. While taking care of them, they need to cover the cash they acquired and the premium on the head.

We’re here to help you how to ascertain advanced interest so you can design your future with assurance. We should begin.

What Is Interest?

We as a whole know about the idea of getting cash from the bank or another monetary organization and taking care of it after some time in portions. Assuming you’re searching for an authoritative definition, we can put it like this: Interest is an expense-paid routinely at a specific rate for the utilization of resources loaned (ordinarily) from a bank or other monetary establishment.

The bank procures by gathering revenue on credits, and you are paying for acquiring and utilizing the bank’s cash.

Presently, here’s the trick: Interest implies you’ll have to repay more than the first advance you took, as you’ll need to factor in the expense of getting the assets. How much premium you need to take care of relies upon a financing cost, which thus relies upon your record, pay level, sort of advance, the general measure of obligation you as of now have, and different factors.

To work out interest on an advance, you took out and its regularly scheduled installments, you’ll require fundamental number-related abilities or an internet-based advance mini-computer. When you get every one of the figures, you can begin arranging your next buy.

The amount Will You Pay?

As we’ve as of now referenced, various factors decide the all-out you’ll need to leave behind en route to taking care of your credit. We should separate the absolute most basic variables:

Chief Amount

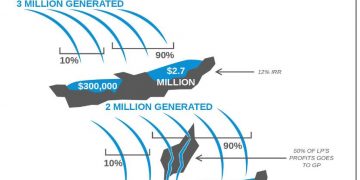

The chief sum addresses the assets you’re anticipating acquiring from a bank. Its effect on the interest on the advance you took is basic: The more you acquire, the higher the interest is, as the loan specialist is expecting a more serious danger. It would be ideal to work out the numbers before you acquire and extract additional cash from your financial plan to diminish the advance.

Here is a model: If the underlying size of the advance is $300,000 and the loan fee is 15%, the all-out total you’ll need to pay toward the finish of the agreement would be $345,000. Nonetheless, assuming that you’re acquiring less cash, your premium sum would be lower, and you will not need to take care of as much eventually.

Advance Term

When attempting to sort out some way to compute interest on credit, you’ll need to think about the time you’re willing to spend paying the obligation. Assuming that you choose to loosen up your installments on 30 years (e.g., for a home loan), your regularly scheduled payments will be lower.

Notwithstanding, longer credit terms likewise imply that the interest you pay will be higher, and the complete aggregate you’ll pay in the end will be greater. That is the reason more limited credit terms are better over the long haul. Indeed, you will have higher regularly scheduled installments, however, you’ll cause less interest and pay less eventually.

Reimbursement Schedule

Another variable that assists you with ascertaining complete interest on an advance and gauging your expenses is the timetable for your reimbursement. Regardless of whether you decide to reimburse week by week, fortnightly, or month to month can be a distinct advantage. Most borrowers pay portions one time per month, as it fits the month-arranged planning style.

Notwithstanding, assuming you pick week after week or fortnightly installments, you could really set aside cash. Specifically, more successive reimbursements cause less interest on the grounds that there’s less an ideal opportunity for it to accumulate. You can decrease the chief that you own quicker by paying all the more frequently.

Reimbursement Amount

As talked about in the “credit term” segment, more limited advance terms mean higher regularly scheduled installments, yet lower interest generally speaking. When working out interest on an advance, consistently find out if the extra installments you’re willing to make the most of will toward your head.

Assuming that the response is positive, you can begin wanting to work on your advance head, in this manner paying off your obligation and interest.

Loan cost

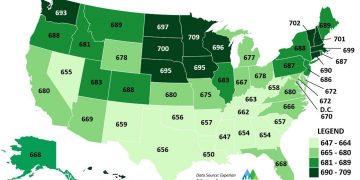

At long last, we’ve come to the main variable deciding the amount you will pay. The banks compute your financing cost by your FICO assessment, general obligation, pay level, sort of credit, and a couple of different things. When the bank gives you a loan fee, try to check whether it’s variable or fixed, as it can have a significant effect.

Paying the credit with a proper premium implies that the rate continues as before for the existence of the advance. Then again, a variable rate advance implies that you’ll be charged relying upon the progressions on the lookout, which can hoist the expenses, yet in addition, lower them essentially (which is the reason this is alluring by any means). Variable-rate credits are more qualified to the people who expect to take care of their advance rapidly, as the market will not have a lot of opportunities to vacillate.

Ascertaining Loan Interest

Since you realize every one of the variables adding to the all-out costs, we should crunch the numbers to sort out your regularly scheduled installments.

Basic Interest

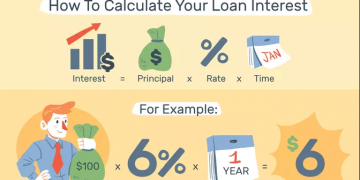

For this kind of estimation, a borrower should accumulate the accompanying data: The financing cost, chief advance sum, and advance term communicated in the number of months or a long time. The credit interest equation goes this way:

Chief advance sum × Annual financing cost × Term = Total Interest

For instance, on the off chance that you’re taking a $20,000 credit with a yearly loan fee of 8% and plan to take care of it inside three years, this is the way to work out the basic interest:

20,000 × 0.08 × 3 = $4,800

The complete aggregate you owe to the bank besides the chief sum would be $4,800, and by and large, that’d make $24,800.

This fundamental computation can provide you with an overall thought of the amount you’ll pay, as things are seldom that basic and normally incorporate different factors that make the condition more convoluted.

Amortization

In the event that you’ve at any point viewed as taking understudy loans, vehicle advances, or a home loan, you’ve most likely known about amortization. Before we delve into subtleties on the best way to compute interest on a credit of this sort, how about we further clarify it. Amortized advances have a decent installment plan and equivalent portions.

In any case, moneylenders apply your installments distinctively over the long haul. Before all else, a greater amount of the cash you are paying every month goes toward paying your premium. Over the long run, the equilibrium shifts, and the bank begins to apply most of your regularly scheduled installments to your chief advance.

Assuming this sounds overpowering, we’ll assist you with working out the numbers utilizing this straightforward interest installment equation:

(Financing cost ÷ the number of installments) × remaining advance equilibrium = Monthly interest paid

You’ll need to partition your yearly financing cost by the number of installments you’re anticipating making that year. To decide how much interest you’ll pay that month, duplicate the number you get by your residual credit balance.

For instance, on the off chance that you have a 6% fixed financing cost on a credit of $5,000 and an advance term of one year, this is the way much you’ll need to pay in the primary month:

(0.06% ÷ 12) × 5,000 = $25

The outcome you have is how much cash you’ll pay as revenue on a credit in the primary month of your installment term. Notwithstanding, as we’ve referenced, amortized advances change needs over the long haul, so how much cash you’ll pay as revenue will diminish, and more cash will be utilized to cover the head.

To get figures for different months, just deduct that premium from your decent regularly scheduled payment to perceive how much cash will go towards the head. You can track down an advance reimbursement mini-computer online to crunch the numbers for you, as well.

Here is a model: If your regularly scheduled payment is $430.33, you’ll pay $405.33 for the head. Presently, rehash the computation with the new excess advance equilibrium you got for each resulting month.

How much cash you’ll pay to cover the premium on an advance will diminish down to just $2.14 somewhat recently of the term, while the cash that will go to cover the chief will increment to $428.19 eventually.

Instructions to Get the Best Rates

Since you know how to compute credit revenue, you can attempt to help your possibilities of getting sensible rates. As currently referenced, banks will gauge the danger they’re taking when loaning you cash and form the credit appropriately. However, there are a few hints and deceives that will assist you with getting the most ideal loan cost.

As a matter of first importance, you should chip away at further developing your FICO rating and keep it over 740, as this will cause you to show up more reliable and allow you to get to more readily advanced choices. Assuming your FICO rating is exceptionally low, you can have a go at supporting it utilizing credit help suppliers or go for signature advances all things being equal.

Go for a short advance term, as more limited obligation reimbursement times secure the wellbeing rates. We know it’s close to incomprehensible with regards to home credit rates, as buying a property requires numerous long stretches of compensation. Be that as it may, as a rule, more limited terms mean higher regularly scheduled installments, however, lower all out interest.

To meet all requirements for a cutthroat credit with sensible financing costs, you ought to likewise chip away at your relationship of debt to salary after taxes (DTI). The DTI is the rate you get while isolating all your month-to-month obligation installments by your gross month-to-month pay. On the off chance that your obligations are stacking up, it’s doubtful you will be conceded an advance, or possibly one you need. Prior to applying, attempt to take care of your obligations or if nothing else merge them with another credit.