To know how Americans are doing monetarily, investigate their FICO assessments.

Financial assessments are vital to deciding if somebody will meet all requirements for a home loan, advance, or Visa and how much interest they’ll pay. They likewise assist shed with lighting on individuals’ monetary circumstances. Regardless of the pandemic, financial assessments rose and normal Visa obligation fell, as indicated by Experian’s yearly State of the Credit report.

- The normal VantageScore is 695.

- The normal FICO score in the U.S. is 716.

- Normal Mastercard obligation tumbled to $5,525 somewhere in the range of 2020 and 2021.

- Minnesota has the most noteworthy VantageScore normal at 726.

- Mississippi has the most minimal VantageScore normal at 666.

Normal FICO rating in the U.S.

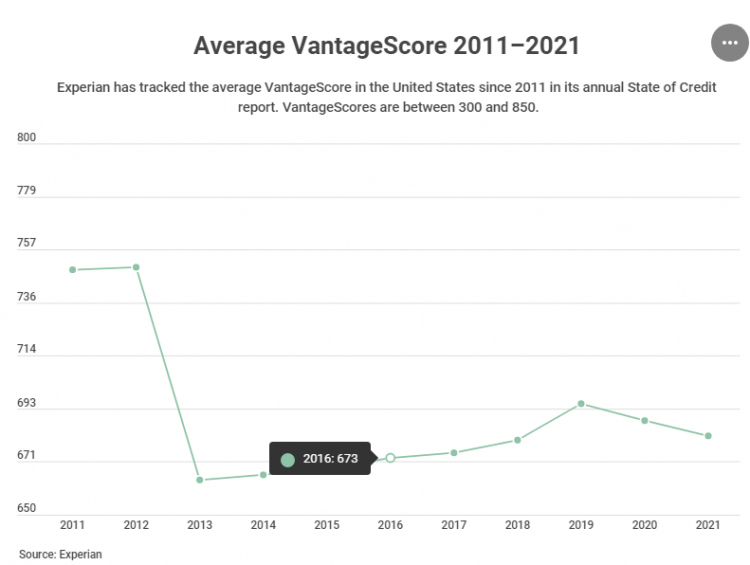

Research by Experian shows that the normal VantageScore in the U.S. in 2021 is 695, and the middle is 707. This is a slight increment from the earlier year, where the normal score was 688, and the middle was 697. Furthermore, the normal FICO score at present sits at 716.

Normal FICO assessments have been moving vertically since the Great Recession when many individuals were battling with cutbacks, submerged home loans, and other monetary issues. Regardless of the pandemic and its related joblessness rates, financial assessment midpoints in the U.S. are up 20 focuses from pre-COVID levels.

Customers with the most elevated and least FICO assessments

People born after WW2 and individuals from the Silent Generation – a considerable lot of whom are mortgage holders with significant reserve funds – partake in the absolute most noteworthy FICO assessments. The most seasoned borrowers concentrated by Experian, for instance, had a normal FICO rating of 729 out of 2021, while children of post-war America partook in a normal score of 724. Individuals from Generation X passage essentially more regrettable, averaging only a 685 VantageScore.

All things considered – yet they’re improving. Recent college grads, for instance, found the middle value of a 667 FICO rating (up from 658 of every 2020), while individuals from Generation Z arrived at the midpoint of a 660 score (from 654 the earlier year).

Normal VantageScore by age

| Age group | 2020 | 2021 |

|---|---|---|

| Silent Generation | 729 | 729 |

| Baby boomers | 716 | 724 |

| Generation X | 676 | 685 |

| Millennials | 658 | 667 |

| Generation Z | 654 | 660 |

Experian’s information shows that despite the fact that Gen Z has the most minimal normal Mastercard surplus at $2,312 and Gen X has the most elevated normal Mastercard total at $7,236 in 2021 and Gen X diminished their credit usage proportions by 6.6%. Gen Z’s normal usage proportion expanded 3.6% somewhere in the range of 2020 and 2021.

Then again, boomers diminished their normal charge card total from $6,474 to $6,230 and their credit use by 9.7% – the biggest abatement among ages – from 23.7% in 2020 to 21.4% in 2021.

Experian State of Credit 2020 credit and obligation insights

| 2021 State of Credit Report | 2019 | 2020 | 2021 |

|---|---|---|---|

| Average VantageScore | 682 | 688 | 695 |

| Median VantageScore | 687 | 697 | 707 |

| Average number of credit cards | 3.0 | 3.0 | 3.0 |

| Average credit card balance | $6,494 | $5,897 | $5,525 |

| Average revolving utilization rate | 30% | 26% | 25% |

| Average number of retail credit cards | 2.50 | 2.42 | 2.33 |

| Average retail credit card balance | $1,930 | $2,044 | $1,887 |

| Average non-mortgage debt | $25,057 | $25,483 | $25,112 |

| Average mortgage debt | $210,263 | $215,655 | $229,242 |

| Average auto loan or lease | $19,034 | $19,462 | $20,505 |

| Average 30–59 days past due delinquency rates | 3.8% | 2.4% | 2.3% |

| Average 60–89 days past due delinquency rates | 1.9% | 1.3% | 1.0% |

| Average 90–180 days past due delinquency rates | 6.6% | 3.8% | 2.5% |

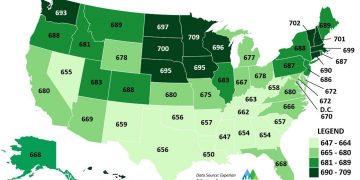

Minnesotans should accomplish something right with regard to dealing with their credit. As per Experian, for the fifth continuous year, Minnesota occupants took the country’s best position for most elevated normal FICO ratings. The normal Minnesota inhabitant partakes in a normal 726 financial assessment, which is sufficiently high to fit the bill for a scope of serious credit items, including large numbers of the best rewards cards.

Vermont inhabitants arrived in a nearby second this year. As per Experian, occupants of the Green Mountain State partake in a normal VantageScore of 719, up 7 focuses from the earlier year. In the interim, occupants of New Hampshire, Washington and Massachusetts likewise have normal scores well over 700.

In spite of the fact that it’s not satisfactory why certain states appreciate higher scores than others, the top-performing states really do share something different in like manner. As per the Census Bureau, a significant number of them gloat moderately high middle wages. For instance, the middle pay in Minnesota is $71,306. In New Hampshire, it’s $76,768 and in Massachusetts, it’s $81,215. The middle pay in the U.S., conversely, is $62,843.

In the interim, a few states with the least normal FICO ratings likewise have the absolute most minimal livelihoods in the nation, making it extreme for some inhabitants to take care of their bills. Mississippi inhabitants not just have the least VantageScore on normal at 666 out of 2021, however, in 2020, the middle pay was the most minimal of all states at $45,081.

Louisiana inhabitants likewise admission inadequately in Experian’s study – occupants have a middle pay of just $49,469 and a normal VantageScore of 669. Experian likewise observed that normal scores in Alabama, Oklahoma, and Texas were among the most minimal from one side of the country to the other.

What installment history means for financial assessment

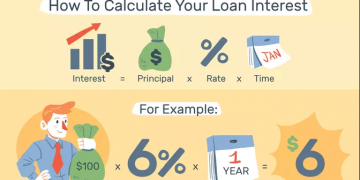

Different elements influence FICO ratings, including how much obligation an individual has, what sorts of credit accounts they have, and how long they’ve been effectively utilizing credit.

The absolute most significant component affecting an individual’s FICO rating, however, is their installment history.

As indicated by extra exploration from Experian, Americans with subprime FICO assessments are paying off past commitments and expanding their scores. Somewhere in the range of 2020 and 2021, subprime purchasers’ normal FICO scores expanded from 578 to 586. Also, their normal obligation diminished 5% from $55,135 to $52,628, and their use proportions diminished from 61% to 55%.[2]

Contrast that with prime borrowers, who have a normal FICO score of 767 and a normal credit use proportion of 16% in 2021. Notwithstanding, prime shoppers have two times as many obligations by and large, at $107,956.

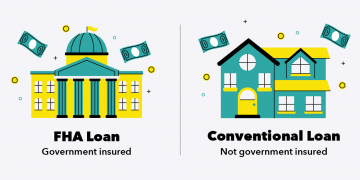

Instructions to decipher your financial assessment

There are two significant credit scoring models in the U.S.: VantageScore and FICO. Both are involved by banks and backers while evaluating applications for Visas and credits. While your financial assessments among VantageScore and FICO may be comparable, they are determined in an unexpected way.