Summary

With most credit departments, the most noteworthy financial assessment conceivable is 850; the main special case is Experian, whose top FICO rating is 999. Not many individuals have the ideal financial assessment, yet it is feasible to further develop your rating and move into the ‘remarkable’ or ‘excellent’ ranges. Complying with time constraints, a long record of loan repayment, and a low credit use rate are the fundamental variables to watch out for.

A FICO assessment is the figure addressing the degree of hazard individual stances to a bank or monetary association assuming it chooses to give them an advance. Financial assessments are estimated on a mathematical scale from 300 to 850. The higher your FICO assessment, the better.

Insights propose that 1.2% of Americans have a top FICO rating in the FICO rating range. Transunion’s most noteworthy financial assessment is something very similar. As a rule, assuming you have a rating of the north of 670 with any credit announcing office, you have a decent FICO assessment.

The Benefits of Having a Great Credit Score

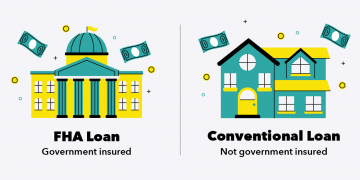

On the off chance that you are applying for an advance or Visa, or hoping to purchase a house, for instance, banks will examine and assess your record as a consumer dependent on the FICO rating diagram prior to choosing whether to endorse your application. Much of the time, moneylenders will hold the best offers and rates for clients with great FICO ratings.

Assuming you have the most noteworthy FICO rating conceivable, you will actually want to get to the broadest scope of monetary items and exploit special rates when getting cash.

Assuming that you have a low FICO rating, you might think that it is hard to acquire cash. Assuming your rating is extremely low, you may not meet the bank’s necessities, so your application could be dismissed. Then again, in the event that you in all actuality do figure out how to get a Visa or credit, the financing costs will be higher.

What’s the Highest Credit Score Possible?

On the off chance that you’re hoping to further develop your FICO rating, you might be posing inquiries like, ‘What’s the most elevated FICO rating you can have?’ or ‘How high can a FICO assessment go?’

The most ordinarily utilized credit scoring goes run from 300 to 850, implying that 850 is the best FICO assessment. This figure addresses the most noteworthy Transunion FICO rating, the most elevated FICO score, and the most elevated FICO assessment conceivable with Equifax.

Experian’s Credit Score

Experian, the third announcing office, has a marginally unique FICO assessment range than FICO, Transunion, and Equifax. The most noteworthy FICO assessment accessible with Experian is 999.

What Is a Very Good Credit Score?

As referenced, simply more than 1% of Americans have the top scores with every one of the three offices. While you might not have the maximum FICO rating, an excellent FICO rating will in any case concede your admittance to particular rates and increment your odds of having the option to get cash or utilize premium monetary items.

FICO financial assessments are delegated as follows:

- Remarkable: 800-850

- Awesome: 740-799

- Great: 670-739

- Reasonable: 580-669

- Poor: 300-579

As per the FICO rating diagram, the least and most elevated financial assessments are 300 and 850. Assuming you have a score of 740 or over, you have an excellent credit score.

The most effective method to Improve Your Credit Score

It may not be feasible for everybody to accomplish the most noteworthy FICO assessment ever, yet there are ways of further developing your FICO rating. Steps include:

1. Making Payments on Time

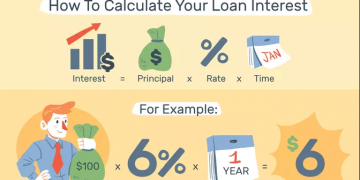

Staying aware of reimbursement is fundamental to accomplishing the most noteworthy conceivable financial assessment. As per FICO, installment history represents 35% of the general FICO assessment, and never missing an installment implies securely further developing your score. Assuming you are over 30 days late with an installment, banks will probably contact the credit agencies, and your FICO assessment will diminish. Late installments can remain on your record for as long as seven years. During this time, you might think that it is trying to get cash.

2. Watch out for Your Credit

The second most significant variable for credit departments is how much credit you have contrasted with the sum you use. This is known as your credit usage proportion, and it represents the following 30% of your FICO rating. To arrive at the amazing financial assessment range, it’s essential to diminish how much credit you use and keep it beneath 30%. The nearer the figure is to 0%, the better your FICO assessment.

3. Try not to Make Too Many Credit Applications

At the point when you apply for a charge card or advance, the loan specialist will check your record as a consumer through a hard credit request, which will show up on your own report. FICO recommends that you can lose up to 5 focuses on the credit diagram for each request. Attempt to restrict the number of utilizations you submit to further develop your score.

4. Check for Errors

Mistakes using loan reports can influence FICO ratings. On the off chance that you have a low score, or your rating isn’t generally so high as you expected, audit the report for botches. During the pandemic, clients could check their credit reports free of charge consistently; customarily, you get one free report from the organizations each year.

5. Develop Your Credit History

Your record represents 15% of your financial assessment. The further back your capacity to acquire cash and pay it back goes, the higher your score will be.

6. Try not to Cancel Cards

Assuming you don’t utilize your cards habitually, oppose the impulse to drop them. Keeping cards dynamic will assist you with developing your record of loan repayment, which will work in support of yourself.

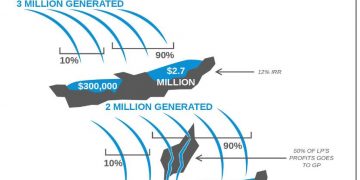

Who Has the Highest Credit Score?

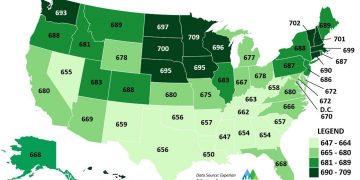

Information from VantageScore proposes that the normal FICO assessment in the US was 697 in July 2021. As indicated by FICO, the normal FICO assessment came to 716 out of 2021. Almost 63% of Americans have a FICO rating of 700-850, and 8.4% of individuals have a score under 550.

As referenced, under 2% of Americans have the most elevated FICO assessment breaking point of 850 with FICO, Transunion, and Equifax.

Individuals who are probably going to have the best FICO assessments share these variables practically speaking:

Wonderful installment record

Hardly any new credit requests

Low credit usage proportion

A long history of utilizing and taking care of credit

The Importance of a Top Credit Score

There are a few critical advantages of having a high financial assessment. On the off chance that you are pursuing the most elevated FICO rating, here are a portion of the justifications for why it’s vital to continue onward:

Lower financing costs and expenses for advances and home loans: If you need to get cash, you will approach lower loan fees assuming that you have a brilliant FICO rating.

More choices: With a generally excellent or extraordinary financial assessment, a more extensive scope of loan specialists and items will be accessible to you.

Admittance to arrangements and motivations: Some motivators presented with Mastercard organizations, for instance, cashback on buys or 0% offers, are simply accessible to clients with top FICO assessments.

Lower expenses: now and again, a decent financial assessment can assist you with getting a good deal on charges, for instance, collision protection.