Building credit requires tolerance. However, with the right monetary items and brilliant credit use, you can fabricate a preferable score a lot speedier than you think.

Peruse our aide underneath on the most proficient method to assemble credit quickly and start your excursion to better monetary wellbeing.

How Do You Build Credit?

Probably the quickest method for building credit is having dynamic credit extensions that grandstand mindful use. This applies on the off chance that you want a credit fixed or on the other hand assuming you are building your credit without any preparation.

Constructing better acknowledge can take just a half year of on-time installments on a credit account. You probably won’t have the best credit first thing, yet you can move gradually dependent upon it by following these means:

Demand and investigate your free yearly credit report

Cover your bills on schedule

Take care of your obligation

Become an approved credit client

Get a gotten Mastercard

Keep up with great credit use

Apply for a credit-manufacturer advance

1. Demand and investigate your free yearly credit report

A credit report is an assortment of informative items about your monetary propensities that make up the structure squares of your FICO assessment. These incorporate credit limits, account adjusts installment history, liquidations, assortments, and credit requests.

Purchasers can demand one free credit report each year from each revealing organization. Track down yours with annualcreditreport.com.

When you have the report, filter through it cautiously. The objective is to observe whatever might be influencing your score, regardless of whether it’s high credit use, incessant hard requests, a slight record, missed installments, or administrative blunders. Our aide on the best way to peruse a credit report might be valuable in this interaction.

Question credit report mistakes

Buyers can question acknowledge report blunders either for the loaning foundation or straightforwardly with the three significant credit authorities: Experian, TransUnion, and Equifax. The cycle is direct; compose a letter that obviously conveys the blunder, and give proof to back up your case. You’ll have to contact each credit agency to ensure the mistake is taken out from all reports.

While you can’t get authentic data eliminated from the report (like a background marked by missed installments), eliminating blunders merits the work in the event that it further develops your score.

Normal credit revealing mistakes include:

Inaccurate individual data

Copied obligation

Blended records – showing another person’s records

Erroneous record equilibrium and credit limits

Negative things past the 7-year point

Enlist a credit fix organization

Credit fix organizations charge a month-to-month expense to draft question letters, tidy up your report and handle leaser dealings. These administrations turn out best for customers with numerous mistakes who don’t have the opportunity to document questions with every organization.

Credit fix organizations can’t charge you forthright for administrations not delivered and above all, they can’t eliminate exact things from your report. Any such guarantee is a warning.

Our audits for the best credit fix organizations will assist you with getting an early advantage, yet prior to settling on an official conclusion, read the credit fix guide segment. There, we raise you to an acceptable level on what’s in store from a credit fix organization and how to pick the right one.

2. Take care of your bills on schedule

Try not to miss installments on any current acknowledge lines, for example, understudy loans, Mastercards or automobile advances. Installment history is the absolute most powerful class for your FICO and VantageScore — the fundamental credit scoring models utilized by loaning foundations. Each late installment hauls down your score, however, the negative imprint stays on the report for a very long time.

Elective record as a consumer — lease and service bills — isn’t accounted for to credit departments, except if the record is late and shipped off an assortment office. Regardless, a background marked by on-time lease and utility installments can work for people with no credit.

Experian Boost and UltraFICO are two genuinely new devices that fuse elective records as a consumer. While this information is excluded from regular credit scoring estimations, it’s one more way for an imminent moneylender to survey your reliability.

Experian Boost catches and factors positive installment movement (like on-time PDA, utility, and lease installments) into your record. Overall, Experian says clients see a 13-point expansion in their financial assessments.

UltraFICO incorporates financial balance movement from a client’s checking, currency market, or bank accounts to give moneylenders a more top to bottom gander at borrowers with a “meager record.”

Ultimately, you can request that your landowner report your installments to the credit agencies. Realize that this can blow up assuming your installment history is negative, as a property manager needn’t bother with the inhabitant’s agree to report installment movement, regardless of whether negative or positive.

To make the best of lease revealing:

Keep proof of installments

Try not to miss any installments

Ask that they report to more than one agency

Check your property manager’s report consistently to guarantee it precisely mirrors your installment history

3. Take care of your obligation

Assuming you have an exceptional portion or charge card obligation, center solely around paying off your obligation trouble prior to continuing on to different things on this rundown.

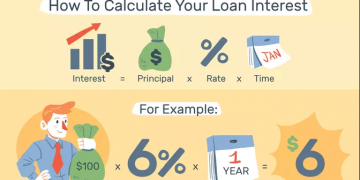

Some obligation installment procedures worth focusing on are:

Pay more than the base, as your spending plan permits

Set up programmed installments and bill suggestions to forestall any missed installments

Utilize the “torrential slide technique” to handle offsets with the most elevated financing costs first

Utilize the “snowball strategy” to take care of the littlest credits first, and slowly increment installments towards bigger advances

Apply for an obligation union advance to bunch all your obligation installments into a solitary advance with fixed financing costs and regularly scheduled installments

Note that taking care of your Mastercard obligation is an extraordinary method for building your credit, yet specialists exhort against dropping or shutting a Mastercard account as it might adversely influence your record and credit usage.

4. Become an approved Visa client

Turning into an approved client on a Visa record can support your own score in the event that it’s finished with somebody with a set up history of good credit.

Guardians regularly help their kids fabricate credit thusly, by adding them to a Mastercard for use while in school, for instance. Not at all like having a co-endorser or a shared service, the essential cardholder actually holds the option to eliminate the approved client from the card.

Turning into an approved client is a not kidding question of trust. Assuming an approved client runs up the Mastercard balance, the essential cardholder will be stuck paying it. Alternately, assuming the essential cardholder falls behind on their Visa installments or maxes out the card, the financial assessment of the approved client could be harmed.