Robo-counselors have ascended to conspicuousness over the previous decade, with the fintech sub-area empowering additional dynamic contributions from more youthful financial backers and the majority in saving and venture. Robo-guides plan to democratize monetary exhortation and bring great administrations, beforehand accessible solely to rich, modern financial backers. More or less, Robo-informing is a structure with respect to speculation the executives that re-appropriates portfolio system to a calculation. Portfolio development and rebalancing are robotized with the assistance of PCs, giving a more reasonable abundance of the executive’s arrangements and a possible decrease in human mistakes and inclination.

Numerous new businesses in the field battle to make back the initial investment and show brand separation. What is the most ideal way for Robo-guides to keep on democratizing contributing and making money while passing on the genuine dangers of a portfolio?

Where Did Robo-exhorting Come from?

Advancement and Wealthfront are two of the most unmistakable Robo-guides, with the previous being quick to send off in 2008. By 2019, the area was assessed to have $440 billion of resources under administration worldwide, and over the long run, customary abundance administrators, similar to Vanguard, have likewise embraced such procedures. While totally not quite the same as execution-just exchanging stages, similar to Robinhood, the two areas’ message of monetary strengthening has been embraced by more youthful financial backers, who generally have not taken a functioning interest in retirement investment funds until some other time in their vocations.

One of the key incentives of famous robot guides is that they assist customers with getting dangers and expenses related to portfolios, rather than zeroing in just on returns. Contentions against conventional monetary consultants drove abundance the executives is the misalignment of motivators, where costly and ineffectively performing resources are channeled to financial backers, who can’t parse the numbers equitably to acquire a view on execution. For that, Robo-consultants have been defenders of aloof contributing, avoiding costly effectively overseen assets for conservative file assets and trade exchanged assets (ETFs).

Hazard Management and Robo-guides

While most robot guides normally utilize the current portfolio hypothesis (now and then related to other well-informed philosophies) to develop financial backer portfolios, they utilize various ways of communicating hazard levels related to those portfolios. Most venture experts concur that hazard is as significant thought as a return in portfolio determination. Indeed, by far most of the specialists keep on being propelled by the mean-fluctuation improvement system showed by Nobel Prize victor Harry Markowitz’s 1952 exposition on portfolio choice.

Be that as it may, the hazard is normally not too perceived by the normal financial backer true to form returns. This is on the grounds that a singular’s danger resilience is driven by past execution and judicious assumptions as well as by remarkable individual conditions and other passionate factors like expectations and fears. Additionally, a singular’s danger resistance is not really a static measure. Most people would determinedly see their danger resistance to be lower in 2020, because of vulnerabilities introduced by COVID-19, than any time during the previous decade. The attractiveness of a suggested portfolio is surveyed by a financial backer part of the way by their own impression of the portfolio’s hazard. To this end, it is crucial for a robot counsel to plainly delineate danger so financial backers can comprehend the peril and relate it to their own resistance, objectives, and enthusiastic inclinations.

Robo-consultants utilize quantitative or subjective measures to assist customers with getting hazards. Each action has its benefits and restrictions.

Subjective Risk Levels: Aggressive or High Growth?

Most robot guides appoint a subjective danger rating dependent on how financial backers answer a predefined rundown of psychometric inquiries. This will by and large reach on a mathematical scale from “Extremely Conservative” to “Exceptionally Aggressive.”

A subjective danger rating enjoys clear benefits, in that it makes seeing the peril of different portfolios comparative with one another simple for a financial backer. For instance, a portfolio appointed a “Forceful” rating might be intrinsically more dangerous than one named “Moderate.” The psychometric inquiries assist restricted with bringing down financial backer capacity to bear misfortunes and distinguish the fitting danger level.

In any case, a subjective rating may not give unmistakable agreement regard to the anticipated fluctuation of the portfolio. It may not be clear the amount more unstable a forceful portfolio is, contrasted with a moderate portfolio. In all likelihood, a danger rating of 6 may not imply that the portfolio is two times as dangerous as one evaluated 3. Likewise, the view of hazard might fluctuate depending on how the danger rating is expressed. Financial backers might see a high-hazard portfolio in an unexpected way, contingent upon whether it is marked “High Growth” or “Exceptionally Aggressive.” Hence such order acquaints a layer of subjectivity with the apparent engaging quality of a portfolio.

My anxiety with Robo-consultant’s over-accentuating subjective danger is that it might provide financial backers with a misguided feeling of safety concerning the continuous presentation of their portfolios. A discretionary danger score across a forceful/moderate reach might be excessively wide and at last end up in imperfect financing arranging choices by financial backers whose conditions might be more intricate than recently suspected. The worries in regards to distorted dangers reverberate in administrative calls about Robo-consultants taking part in foundational mis-selling, with financial backers neglecting to comprehend the real essence of the item.

Expanded reception of institutional quantitative danger measures (utilized by banks, assets, and family workplaces) with client instruction could be the way into the following phase of Robo-exhorting. This could truly push the business ahead and relate with public developments for expanded monetary proficiency training.

Quantitative Risk Measures for Investment Portfolios

Restraining Volatility: Value at Risk

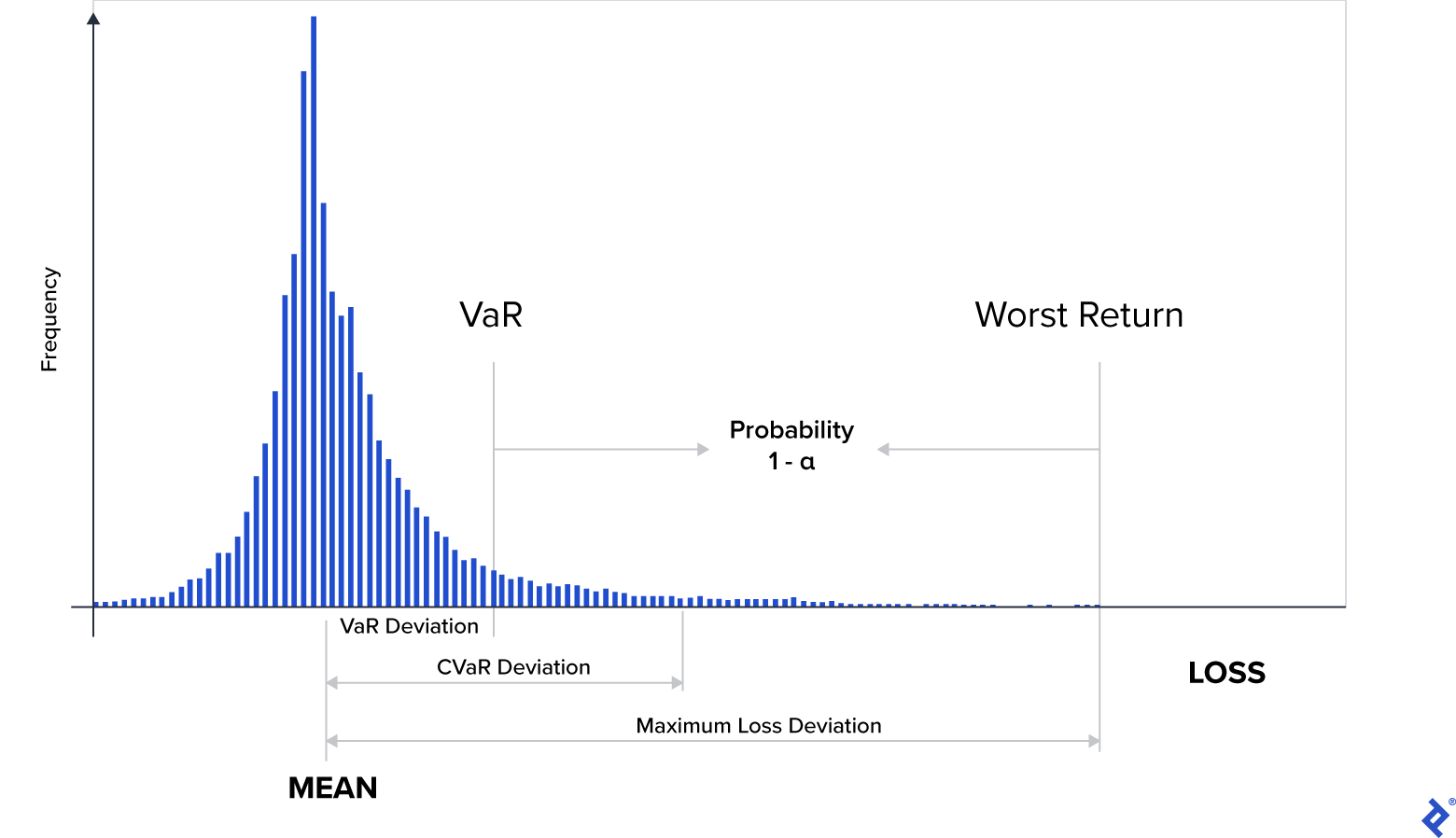

The esteem at Risk, or VaR, is the most well-known proportion of unpredictability of a portfolio. Basically, VaR is a proportion of least expected misfortunes as a specific likelihood level (otherwise called certainty level or percentile). For instance, assuming a portfolio’s almost all the way VaR is 12%, it implies that there is a close to 100% possibility that misfortunes from the portfolio won’t surpass 12% during a given period. As such, there is a 1% possibility that portfolio misfortunes will be over 12%. VaR is now applied by some robot consultants, with one such illustration of utilization being from Singapore’s StashAway, which marks an almost 100% rule into an action called the “Hazard Index.”

VaR can be determined utilizing various strategies. The authentic strategy sorts chronicled returns of a portfolio by greatness and distinguishes the return seen at a specific percentile (ordinarily 95% or close to 100%). The change covariance technique accepts that profits are typically disseminated and utilizes the portfolio’s standard deviation to appraise where the most exceedingly terrible 5% or 1% returns will lie on the chime bend. VaR can likewise be assessed utilizing Monte Carlo reproduction, which produces the most noticeably awful 5% or 1% returns dependent on probabilistic results.

The notoriety of VaR emerges from the way that it makes it simple for a financial backer to comprehend the inconstancy of a portfolio and relate it to their own capacity to bear misfortunes. Nonetheless, we can get various outcomes relying upon information sources and approaches used to compute VaR, influencing the unwavering quality of the action. Additionally, VaR depends intensely on various suspicions, for example, returns being typically dispersed and adjusted to authentic returns. At long last, a close to 100% VaR of 12% (portrayed above) doesn’t illuminate the financial backer in regards to how much misfortunes can be anticipated in the direst outcome imaginable.

The different provisos behind VaR might be restricting its conspicuousness in Robo-prompting stages, with it being viewed as a confounded measurement for clients to comprehend. The case of StashAway marking it into a more edible measurement shows how these boundaries can be separated all the more pertinently.

Contingent Value at Risk

Tending to one of the inadequacies of VaR, the contingent worth in danger, or CVaR, gives the normal misfortune to a financial backer in the direst outcome imaginable. At a certainty level of close to 100%, CVaR is determined as the normal portfolio returns in the most exceedingly awful 1% of situations. CVaR is assessed involving comparable strategies as VaR. While it might help give a more clear image of the direst outcome imaginable contrasted with VaR, it might experience the ill effects of comparative weaknesses because of the suppositions and strategies utilized in assessment.

Market detaches of 2020 will more often than not tear up typical circulation designs, showing that adding more “3-layered” portfolio hazard measures, as CVar, can be invaluable. Related to standard VaR measure, CVaR information would upgrade the danger of the executive’s contributions of a Robo-counselor and be appropriate, taking into account that most of the robot resources are list reserves (bushels of stocks).

Best and Worst Returns

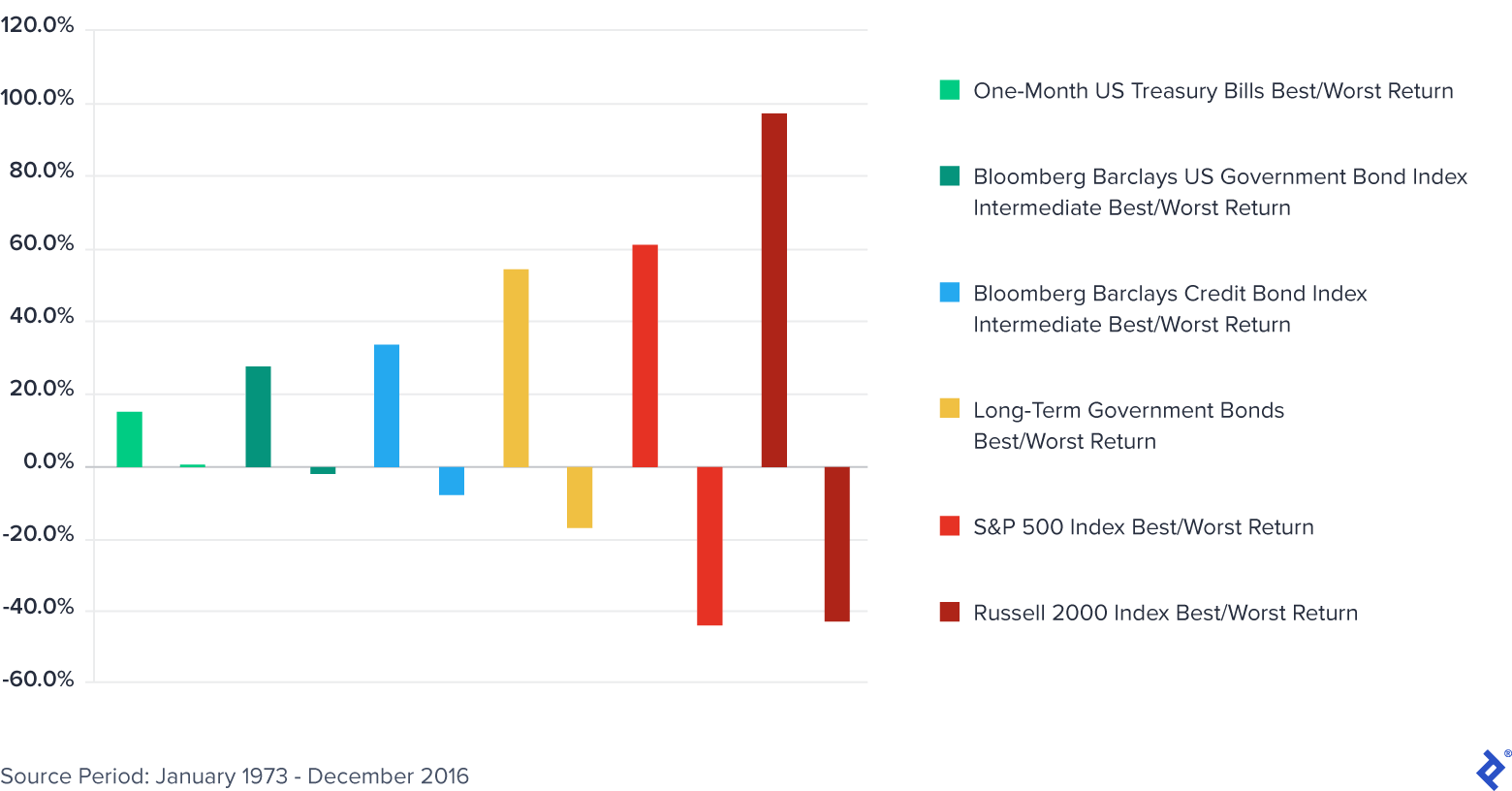

The best and most noticeably terrible returns connect with moving occasional returns of a security or portfolio during a given time skyline. The return can be determined on an everyday, month to month, or yearly premise, contingent upon the financial backer’s time skyline. The time span is normally controlled by the accessibility of information, however, it can affect the best and most exceedingly terrible noticed returns assuming that we don’t utilize an adequately long time skyline.

Best and Worst Returns for US Assets: 1973-2016

The action utilizes recorded re-visitations of providing financial backers with a sign of the best and most pessimistic scenario situations. One clear benefit is that, not normal for VaR, it recognizes positive and negative returns, rather than expecting an ordinary conveyance. Financial backers keep an eye on wouldn’t fret positive unpredictability and for the most part stress over outright disadvantage hazards. Likewise, not at all like CVaR, it shows the most awful noticed returns as opposed to taking a normal of profits, which might misjudge the most pessimistic scenario scena