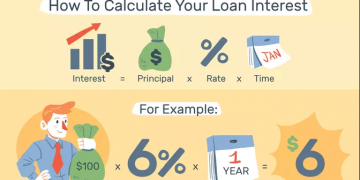

Fixed-rate contracts have low-loan fees and this makes them a well-known choice for homebuyers. Assuming you pick fixed-rate contracts, you have the solace that your regularly scheduled installments won’t rise. You know right from the beginning that the loan fee won’t ever go up in any event, when the economy is poor. Likewise, assuming that the financing cost is higher than the fixed-rate contract then the reimbursements will be lower. Be that as it may, there are impediments to fixed-rate contracts.

Variable-rate contracts are for the most part known to have higher financing costs than fixed-rate advances, yet on the off chance that you can design well, you could bring down your regularly scheduled installments. One of the upsides of a variable-rate advance is the way that assuming the loan costs go down you could profit from the lower loan fees. Additionally, assuming you get a low-financing cost you can set aside a great deal of cash consistently. A variable-rate credit will expand your regularly scheduled installments however assuming that you figure out how to take care of your advance in time then it will save you from paying exorbitant loan costs and it will likewise bring down your regularly scheduled installment.

Before you pick the kind of home loan you need to take out, it is vital to consider the amount you can bear to pay for a home loan. It is critical to do explore the variable home loan rates and contrast them and the current financing costs to realize what is the most ideal choice for you. The more extended the basic time frame, the lower the loan fee as well as the other way around.

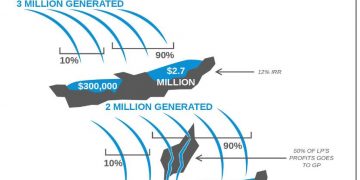

Exploration ought to be done to ensure that you can fit the bill for the home loan that will suit your necessities and prerequisites. The fundamental factors that influence your qualification incorporate your work history, current pay, and your level of training. At the point when you have finished the whole course of applying for a home loan, you should contact your bank. You might even need to converse with your moneylender about any extraordinary choices accessible to you. There are many home purchasing help programs that a loan specialist can propose to assist you with meeting all requirements for a home loan. These projects will bring down your financing cost and may likewise lessen the general advance sum that you want to reimburse.

Contract rates change and relying upon the worth of the property will decide the home loan that will suit you. Fixed home loans accompany fixed financing costs and this is the best home loan for individuals who need to get their future and can make their home loan installments for a long time to come. Movable home loans accompany adaptable financing costs and they are an optimal decision for youthful families. In the event that you intend to sell your home within a brief timeframe, movable rate contracts accompany more limited reimbursement periods.

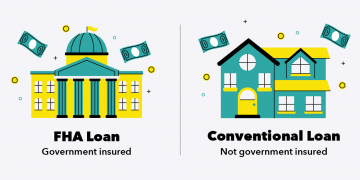

At the point when you begin looking for a home, you wouldn’t believe the distinctive home loan offers that you get. It is ideal to look around with a few moneylenders to get the best rate. Your financial assessment will decide the kind of home loan that you will meet all requirements for and there are moneylenders who spend significant time in offering advances for individuals with low FICO ratings or even no FICO ratings. Before you settle your home loan you genuinely should guarantee that the bank is an ideal best for yourself and this implies that they will check out your monetary circumstance prior to offering you an advance.

Utilizing a home loan specialist can make the entire cycle a lot simpler. The main advance with regards to picking the right home loan specialist is that you feel great and that you can trust them. Being alright with who you manage is vital. Assuming you don’t feel quiet with the individual who is taking care of your home loan deals then, at that point, odds are high that you won’t get the best arrangement. Subsequently, set aside time before you settle on your official conclusion and set yourself straight.