Triple net (NNN) properties present various freedoms for financial backers keen on acquiring a constant flow of solid pay. Regardless of whether you favor high-hazard speculation properties, NNNs are a fundamental expansion to any portfolio – their generally safe, the executives-free nature is an incredible method for broadening your possessions and give a reliable kind of revenue you can rely on, conceivably for a really long time.

Likewise, with any speculation, due persistence is fundamental, however since the strength of a triple net is generally subject to the nature of the inhabitant and the rent, these are the regions that warrant unique thought.

1. NNN Tenant Creditworthiness

The worth of business land (CRE) speculations is emphatically impacted by the strength of the occupant. Occupants ought to have the option to cover lease and utilities, and on account of office and some retail inhabitants, share in the expense of keeping up with public spaces.

With regards to significantly increasing net rent inhabitants, they are answerable for covering practically all costs related to the property. This incorporates utilities, local charges, protection, and fix and upkeep costs notwithstanding the month-to-month cost of renting the property. That is the reason it’s particularly significant you guarantee any inhabitants you think about when buying a NNN property are reliable.

The most ideal way to do this is to assess occupant financial soundness utilizing a standard rating framework like Standard and Poor’s (S&P Global Ratings), Moody’s Investors Service, and Fitch Ratings. S&P is by and large the most believed rating while assessing CRE properties.

Kinds of Credit Ratings

S&P Global Ratings appoints FICO assessments going from AAA to D. Appraisals to mirror an applicant’s capacity to meet their monetary responsibilities are a mix of letters, pluses, or minuses to demonstrate strength.

AAA is the most noteworthy rating; meaning “amazingly impressive ability to meet monetary responsibilities,” and the least is D, which demonstrates the up-and-comer has as of now defaulted. A BBB rating implies the organization has “sufficient ability to meet monetary responsibilities, however, is more dependent upon unfavorable financial conditions.”

With regards to NNN rent properties, inhabitants with at least BBB (with any mix of pluses or minuses) give minimal danger of default and are the favored occupant type. These speculation grade occupants give more noteworthy solidness of pay and esteem and can lessen your openness to hazard in an unpredictable market.

2. Decide the Strength of the Lease Agreement

As implied before, when you purchase a triple net rent property you’re truly purchasing the rent rather than the property or the land. In the event that the property was unfilled, it would have less worth, and as the nature of the inhabitant increments, so does the worth of the property.

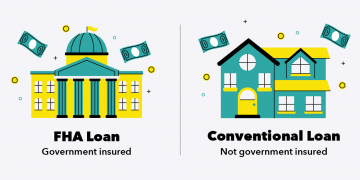

Sporadically, a financial backer will purchase a net rent property with the supposition that it is an outright triple net rent when actually it’s an altered triple net (NN+) or even a twofold net (NN), which frequently have a rent provision expressing that the landowner is answerable for rooftop, structure, and additionally parking garage. That is the reason it’s basic you look at the rent cautiously before you start reviews, statistical surveying, or some other due determination exercises.

One specific space of concern is whether or not the rent determines occasional lease increments, and provided that this is true, would they say they are associated with a reasonable market rate? This is significant since NNN leases can go somewhere in the range of 10 to 20 years, yet on the off chance that there is no convenience made for expansion, you as the proprietor could wind up losing a lot of cash.

The following region you’ll need to examine is the tax collection trouble and different charges as characterized in the rent. In triple net rents, the weight of covering local charges and protection, normal region support (CAM) expenses, and some other expenses are commonly paid by the organizations backing the rent.

In changed NNN leases, the expenses and protection are normally paid by the occupant, in any case, some CAM charges may not be – to this end it’s critical to peruse the whole rent and know precisely where your obligations lie.

3. Look Out for Inflated Lease Rates

From the start, numerous financial backers would be excited to have an inhabitant that pays more than the market rate for their rent. All things considered, who would rather not get more cash flow? Be that as it may, keep an eye out for expanded rent rates.

In all honesty, this is really something you need to keep away from, for three significant reasons.

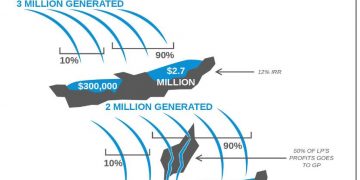

Assuming an occupant is following through on more than the genuine market cost for lease, that implies the deal cost will likewise be higher than whatever it ought to be. The deal cost of a triple net property depends on how much income the property gets, and assuming this number is expanded, then, at that point, you’ll wind up paying more cash than you ought to.

What will happen when the rent closes for this inhabitant? They might choose to move to an alternate property. Much more terrible, they might leave the business, and afterward, you’ll be left with a property that must be dissolvable when the occupant pays a higher-than-typical market rate.

At the point when you’re left with an empty structure, notwithstanding the costs you’d bring about advertising the property, you currently need to pay every one of the costs that were beforehand the inhabitant’s liability. That is a serious dilemma recommendation that could constrain you to get rid of the property in an inopportune time.

The most ideal way to stay away from this is to research standard market rates. Assuming you can’t get that information, you can contrast the supplanting esteem with the price tag. Basically separate the cost per square foot for each, and assess the distinction between them.

There is a connection between’s what it expenses to modify the property and the market cost, and despite the fact that they will not be actually something similar, assuming it’s too high, then, at that point, the inhabitant is logical paying rent that is ridiculously off the mark with market costs.

To realize genuine standard market costs, the least demanding and most dependable way is to connect with a Westwood Net Lease Advisor who can give that data to you, at no expense.